The Act 34 plan prioritizes safety, modern academics, and community access—financed with steady, predictable payments. No frills, just the essentials our students and community need.

Official campus rendering showing planned improvements.

The best way to show your support is to email the SV School Board at schoolboard@svsd.net

Practical upgrades that serve our 7,500 students and the broader community, with a clear focus on safety, academics, and responsible stewardship.

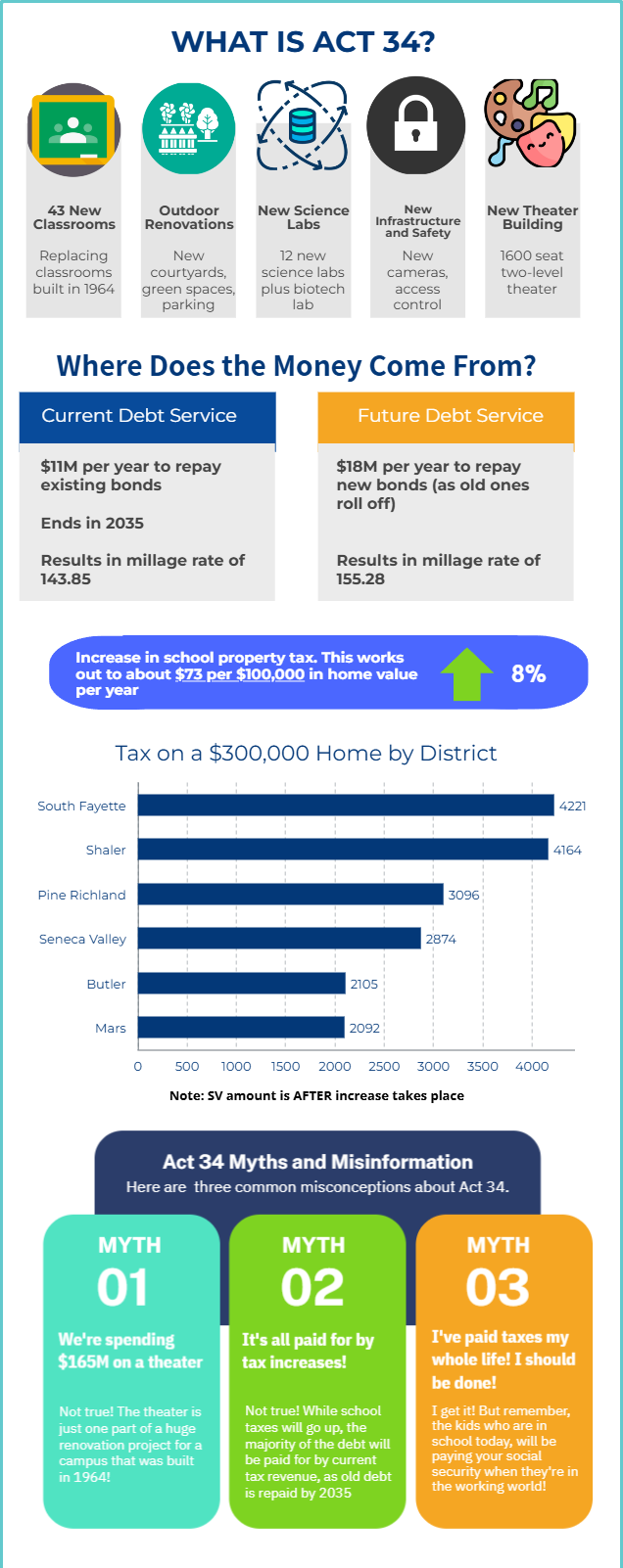

Adds 43 classrooms (39 new + 4 renovated), 12 flexible science labs, and a biotech lab to modernize STEM instruction.

A 1,600-seat theater (1,100 main + 500 balcony) designed for districtwide music, theater, and community events. Maximum 18% of total project cost.

Revenue generating: Available for rentals and community events, helping offset operational costs.

Upgrades to the cafeteria, auditorium, main gym, and locker rooms for improved accessibility and modernization.

A new three-story addition links IHS and SHS for safer, unified movement between buildings.

Secure entry vestibule, controlled access systems, impact-resistant glass, new cameras, and improved visibility for administrators.

Replaces end-of-life mechanical, electrical, plumbing, lighting, and roofing; upgrades data, HVAC, and fire-safety systems.

New front plaza, courtyard, rooftop classroom, campus green with storm-water features, and added accessible parking.

Energy-efficient LED lighting, improved envelope, daylight harvesting, water-saving systems, and green-roof elements.

Facilities designed for expanded evening and weekend access for public arts, performances, and gatherings.

The plan uses established, conservative financing with predictable annual payments as older debt rolls off. Tax increases are gradual and inflation-limited, avoiding sudden spikes while leveraging $20M from existing capital reserves to reduce borrowing costs.

$20M from existing reserves used to reduce borrowing costs and lower the total debt burden.

This strategic use of reserves demonstrates fiscal responsibility and reduces taxpayer impact.

Series 2026: $156M over 20 years at ≈ 4.65% interest.

≈ $9.9M offsets borrowing needs.

None assumed due to the PlanCon moratorium.

Not feasible per district financial analysis.

“Wrap-around” financing keeps annual payments steady (~$18.9M) as older debt rolls off.

10.93 mills (debt) + 0.50 mills (operations) = 11.43 mills total.

≈ $73 per $100,000 of home value per year (≈ $219 for a $300k home).

Even after this increase, Seneca Valley's effective property tax rate is the 5th lowest among comparable western PA districts.

Estimate your annual and monthly tax increase. Uses ≈ $73 per $100,000 of home value (11.43 mills).

With "wrap-around" financing, total annual payments stay steady as older debt retires—reducing risk of spikes. The plan focuses on safety, core academics, and community access.

Competitive rates: Even with this investment, SV maintains the 5th lowest effective property tax rate among comparable western PA districts.

Structured to avoid large year-to-year jumps.

Secure entries, visibility, and modern systems.

Modern labs and classrooms for STEM and arts.

Spaces designed for events and public use.

Annual property tax comparison for a $300,000 home across neighboring districts.

Note: SV amount is AFTER increase takes place.

Quick answers to common questions about the campus improvement plan

Click to view full size

This infographic summarizes key aspects of the Act 34 plan. Click to view full size. For detailed information, see the sections above or download the full document below.

Review the full plan and add your name in support.